Imagine this: you’ve been battling debt for what feels like forever. Every month, the bills pile up, gnawing at your peace of mind. You’ve made sacrifices, tightened your budget, and worked tirelessly to stay on top of it all. Then, finally, the day arrives. The day you’ve been dreaming of. Your last payment is made, your debt is cleared, and you’re free.

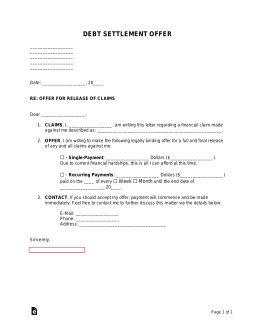

Image: bestprofessional-template.blogspot.com

This is the power of a paid-in-full letter from a creditor. It’s not just a piece of paper; it’s a symbol of triumph, a testament to your resilience, and a beacon of hope for a brighter financial future. In this guide, we’ll explore the importance of this letter, delve into its key components, and provide you with a sample letter you can use as inspiration for your own debt-free journey.

A Letter Worth More Than Gold

A paid-in-full letter from a creditor signifies more than just a completed payment. It’s a formal declaration that your account is fully settled, a record of your financial achievement, and a vital piece of documentation for your future financial stability. This letter offers:

-

Peace of Mind: Finally, you can breathe easy knowing that your debt is gone, and you won’t be plagued by late fees, penalties, or the constant fear of collection agencies.

-

Clean Slate: This letter acts as a reset button, allowing you to start anew with a fresh financial slate. You can move forward without the burden of past debts.

-

Improved Credit Score: Paying off a debt, especially if it was a significant one, can have a positive impact on your credit score, making it easier to secure loans, credit cards, and other financial products.

-

Protection Against Unexpected Issues: Your credit history is a powerful tool. A paid-in-full letter can protect you if a creditor makes a mistake and claims you still owe them money, providing you with concrete evidence.

-

Personal Satisfaction: Reaching this milestone is a significant achievement, a testament to your commitment to responsible financial management. It’s a moment worth celebrating!

Decoding the Anatomy of a Paid-in-Full Letter

This seemingly simple document holds immense value. Here’s a breakdown of what it usually includes:

-

Creditor Information: The letter starts by clearly identifying the creditor sending the letter, including their official name, address, and contact details. This ensures you know exactly who you’re dealing with.

-

Your Information: Your full legal name, account number, and any other relevant identifiers are included to ensure accuracy and prevent misidentification.

-

Account Details: This section specifies the exact account that has been paid in full, including the original amount owed, any interest or fees that were accrued, and the date of the final payment.

-

Statement of Payment: The heart of the letter is the clear and unambiguous statement that your account is fully paid in full. This confirms that you are no longer responsible for any outstanding balance.

-

Closing Remarks: The letter might include a thank-you for your business, a message about the creditor’s commitment to customer satisfaction, or a simple confirmation that they will maintain your account records for future reference.

Crafting Your Own Paid-In-Full Letter: An Inspiration

While most creditors send out these letters automatically upon full payment, you might occasionally need to request one. Or, you may simply want to create your own as a personal record of your debt-free journey. This template can help:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Creditor Name]

[Creditor Address]

Re: Account Number [Account Number]

Dear [Creditor Name],

This letter is to formally request confirmation that my account with account number [account number] has been paid in full. I have submitted my final payment on [Date of final payment] and am confident that the outstanding balance has been settled.

I kindly request that you issue a paid-in-full letter to confirm this information. This documentation is essential for my personal records and future financial planning.

Thank you for your time and assistance.

Sincerely,

[Your Name]

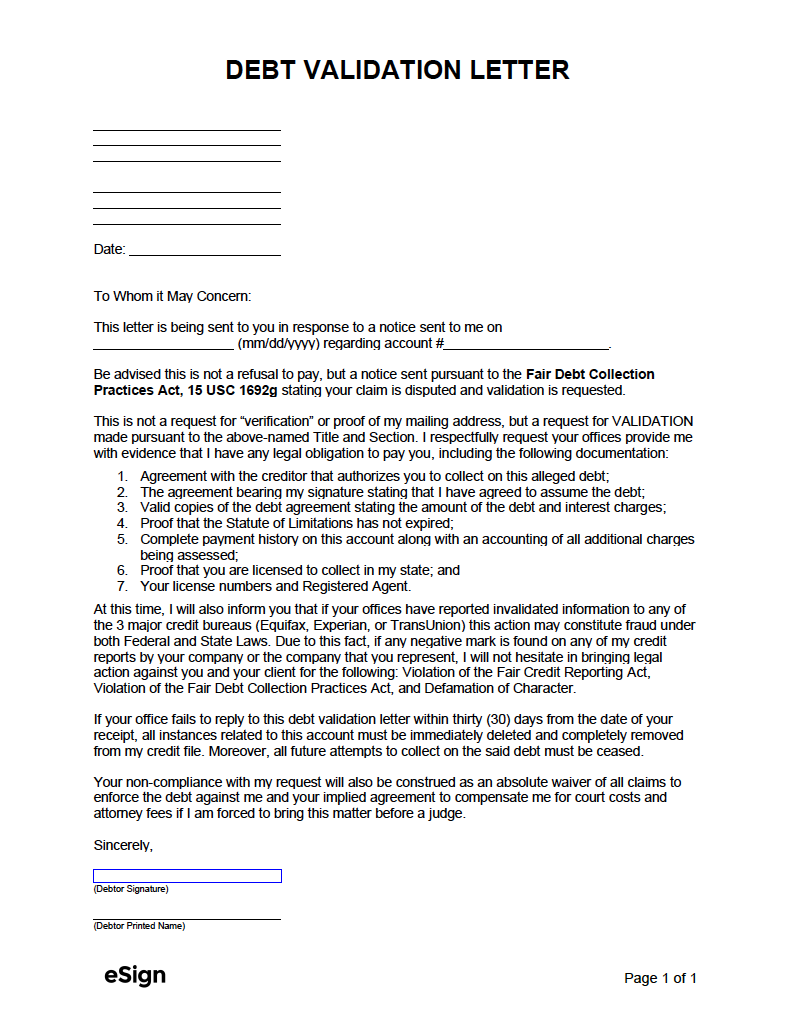

Image: printable-templates1.goldenbellfitness.co.th

Leveraging Your Paid-In-Full Letter: Moving Forward

Your letter is more than just a piece of paper; it’s a symbol of your financial success. Here’s how you can put it to good use:

-

Keep it Safe: Maintain a safe and secure file for all your important financial documents, including your paid-in-full letter. This way, you’ll always have easy access to it when you need it.

-

Celebrate Your Triumph: Take a moment to acknowledge your achievement! You’ve worked hard, made sacrifices, and overcome a major obstacle. Celebrate your newfound financial freedom with a small reward or an enjoyable experience.

-

Focus on Long-Term Stability: Now that you’re free from debt, create a solid financial plan for the future. This could involve setting financial goals, building savings, and investing wisely.

-

Share Your Story: Inspire others! Share your journey of overcoming debt with friends, family, or online communities. By sharing your story, you can help others find the strength and motivation to embark on their own journeys to financial freedom.

Sample Paid In Full Letter From Creditor

The Empowering Journey to a Debt-Free Life

A paid-in-full letter from a creditor is the culmination of a journey—a journey that requires dedication, sacrifice, and unwavering willpower. It’s a testament to your strength and a source of inspiration for others. As you celebrate this milestone, remember that financial freedom is an ongoing journey, a path that’s paved with careful planning, responsible choices, and a relentless pursuit of financial stability.