Have you ever found yourself in a situation where you needed to claim money belonging to someone else but weren’t physically present to do so? Perhaps it was a refund, a forgotten deposit, or even an inheritance. In such cases, an authorization letter is a crucial document that empowers you to act on their behalf and claim the funds smoothly. This article will delve into the world of authorization letters, exploring their significance, key elements, and how to craft a simple, effective sample for claiming money.

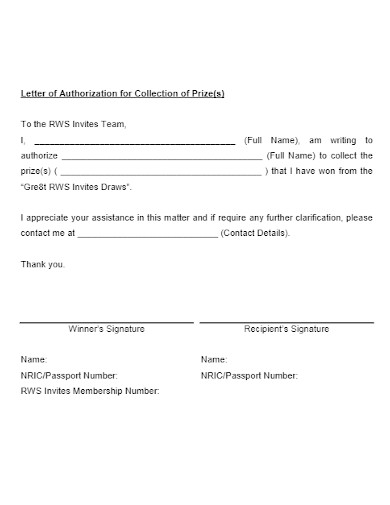

Image: www.examples.com

Imagine this: your grandmother entrusted you with a financial document related to her savings. Unfortunately, she’s unable to visit the bank in person to claim her due funds. This is where an authorization letter emerges as your lifesaver, granting you the legal authority to act on her behalf. Let’s explore this essential document further and understand its importance in handling financial matters.

Understanding Authorization Letters: Empowering Legal Representation

Defining Authorization Letters:

An authorization letter is a written document that delegates authority to another person to act on your behalf in a specific matter. This letter formally empowers the designated individual to perform actions, such as signing documents, collecting funds, or making transactions on your behalf. When it comes to claiming money, the letter explicitly authorizes the recipient to receive and claim the funds, ensuring they have the legal backing to do so.

Importance of Authorization Letters for Claiming Money:

Authorization letters are vital for claiming money when you are unable to do so personally. They provide the necessary legal basis for the designated individual to act on your behalf, allowing them to:

- Claim refunds and rebates.

- Receive payments for services or goods.

- Withdraw funds from bank accounts.

- Claim insurance reimbursements.

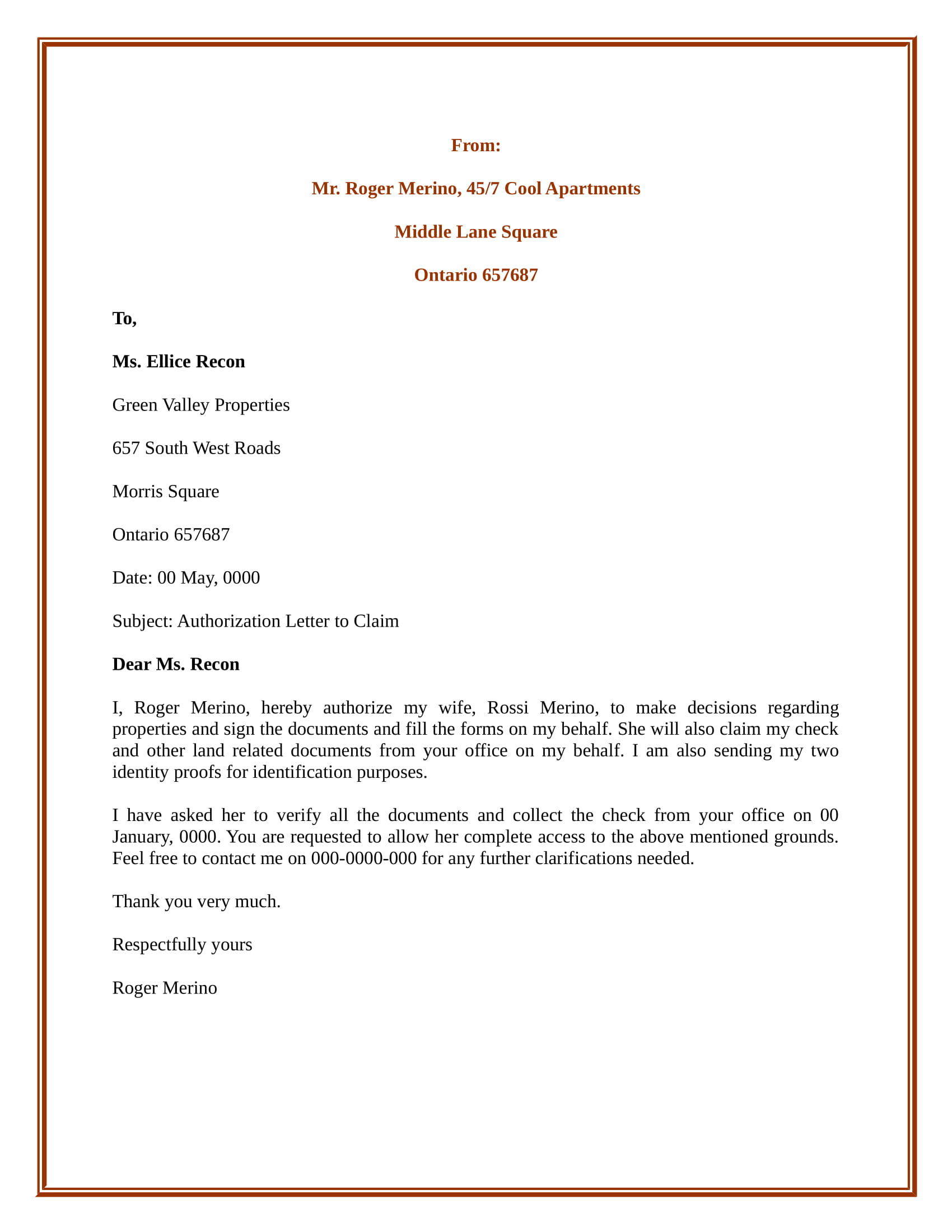

Image: www.examples.com

Key Elements of a Simple Authorization Letter for Claiming Money:

A robust authorization letter includes essential elements for its validity and effectiveness. These include:

- Your Personal Information: Include your full name, address, and contact details.

- Recipient Information: Specify the name, address, and contact details of the individual authorized to claim the money.

- Specific Purpose: Clearly state the specific reason for the authorization, such as claiming a refund, receiving a payment, or withdrawing funds.

- Amount and Source of Funds: Mention the approximate amount of money to be claimed and the source or origin of the funds (e.g., bank account, insurance claim, refund, etc.).

- Authorization Statement: Officially authorize the recipient to act on your behalf, including claiming the money and signing any necessary documents.

- Date: Include the date of writing the letter.

- Signature: Sign the letter with your full name and original signature.

A Sample Authorization Letter for Claiming Money:

Date: [Date]

To: [Name of Recipient]

Address: [Address of Recipient]

Dear [Recipient Name],

This letter serves to authorize you to claim an amount of [Approximate Amount] on my behalf. These funds are related to [Source of Funds, e.g., a refund from [Company Name] for [Product/Service].

I hereby authorize you to sign all necessary documents and take all actions required to claim the said funds. I understand that this authorization is valid until revoked by me in writing.

Sincerely,

[Your Full Name]

[Your Signature]

Tips and Expert Advice for Effective Authorization Letters:

Crafting an authorization letter that effectively fulfills its purpose requires careful attention to certain factors. These tips will guide you in creating a document that is both legally sound and efficient in achieving your objectives:

- Be Clear and Concise: Avoid using complex legal jargon or ambiguous language. State your intentions plainly and directly.

- Specify the Scope of Authorization: Clearly define the specific actions the authorized individual is permitted to take, leaving no room for misinterpretations.

- Include Essential Details: Don’t omit crucial information like the amount to be claimed, the source of funds, and the recipient’s contact details.

- Properly Date and Sign: Always include the date, and ensure your signature is legible and authenticated.

- Seek Legal Guidance: If you have complex or intricate financial matters, it’s wise to consult with a legal professional to ensure your authorization letter is legally compliant.

Frequently Asked Questions (FAQs) about Authorization Letters for Claiming Money:

Q: Is a notarized authorization letter required for claiming money?

A: The requirement for notarization depends on the specific situation and the institution handling the funds. Some organizations, particularly financial institutions, may request a notarized authorization letter to ensure legitimacy. It’s best to inquire with the relevant entity to confirm their requirements.

Q: Can I authorize someone to claim money without their knowledge?

A: No, it’s unethical and potentially illegal to authorize someone to act on your behalf without their consent. The authorization letter should be granted willingly and knowingly by both parties.

Q: What happens if I revoke the authorization later?

A: If you wish to revoke the authorization, you should do so in writing. Notify both the recipient and the institution handling the funds about the revocation, specifying the date it takes effect.

Q: Can an authorization letter be used for multiple purposes?

A: It’s generally advisable to create a separate authorization letter for each specific purpose. This helps to ensure clarity and avoid any ambiguity in the scope of the authorization.

Simple Authorization Letter Sample To Claim Money

https://youtube.com/watch?v=APq-hZ0vlQo

Concluding Thoughts and Call to Action:

In conclusion, crafting a simple authorization letter is crucial for smoothly claiming money when you cannot do so in person. By understanding the essential elements and following the tips provided, you can effectively empower someone to act on your behalf and navigate the process seamlessly.

Are you currently in a situation where you need to claim money but cannot do so personally? Share your experiences or ask questions in the comments below!