Have you ever found yourself staring at a seemingly endless string of numbers on a bank slip, wondering what magical code they hold? Routing numbers, those seemingly cryptic sequences of digits that accompany bank transactions, may seem like a mystery to some, but they are in fact the crucial keys to a smooth and secure financial system. Today, we’ll unravel the secrets of Royal Bank of Canada routing numbers, shedding light on their purpose, significance, and how they impact your banking experience.

Image: cansumer.ca

Understanding routing numbers is essential for anyone who interacts with the Canadian banking system. Whether you’re sending or receiving money, making online payments, or simply making sense of your bank statements, these numbers play a pivotal role in ensuring your transactions reach their intended destinations and are processed accurately.

What Are Royal Bank of Canada Routing Numbers?

Routing numbers, also known as transit numbers in Canada, are unique identification codes assigned to each financial institution. In the context of Royal Bank of Canada (RBC), these numbers act as a specific address for its various branches and departments. They guide the flow of money between accounts and institutions, ensuring it reaches the right destination.

Why Are Routing Numbers So Important?

Imagine a complex network of interconnected pathways that carry financial transactions throughout Canada. Routing numbers are like the signs and directions that guide these transactions, ensuring they travel along the designated routes and arrive at their final recipients.

Where Can I Find My RBC Routing Number?

You can easily find your RBC routing number in several ways:

-

RBC Online Banking: Log into your RBC online banking account, and you’ll likely find it prominently displayed in the account summary or settings section.

-

RBC Mobile App: Access the same information through the RBC mobile app.

-

RBC Bank Statements: Check the bottom or top of your bank statements for the routing number.

-

RBC Checkbooks: Most RBC checkbooks will list the routing number in the upper left or right corner.

-

Direct Deposit Form: If you’re setting up direct deposit, the employer or organization will often provide a form that requires you to enter your routing number.

Image: www.settler.ca

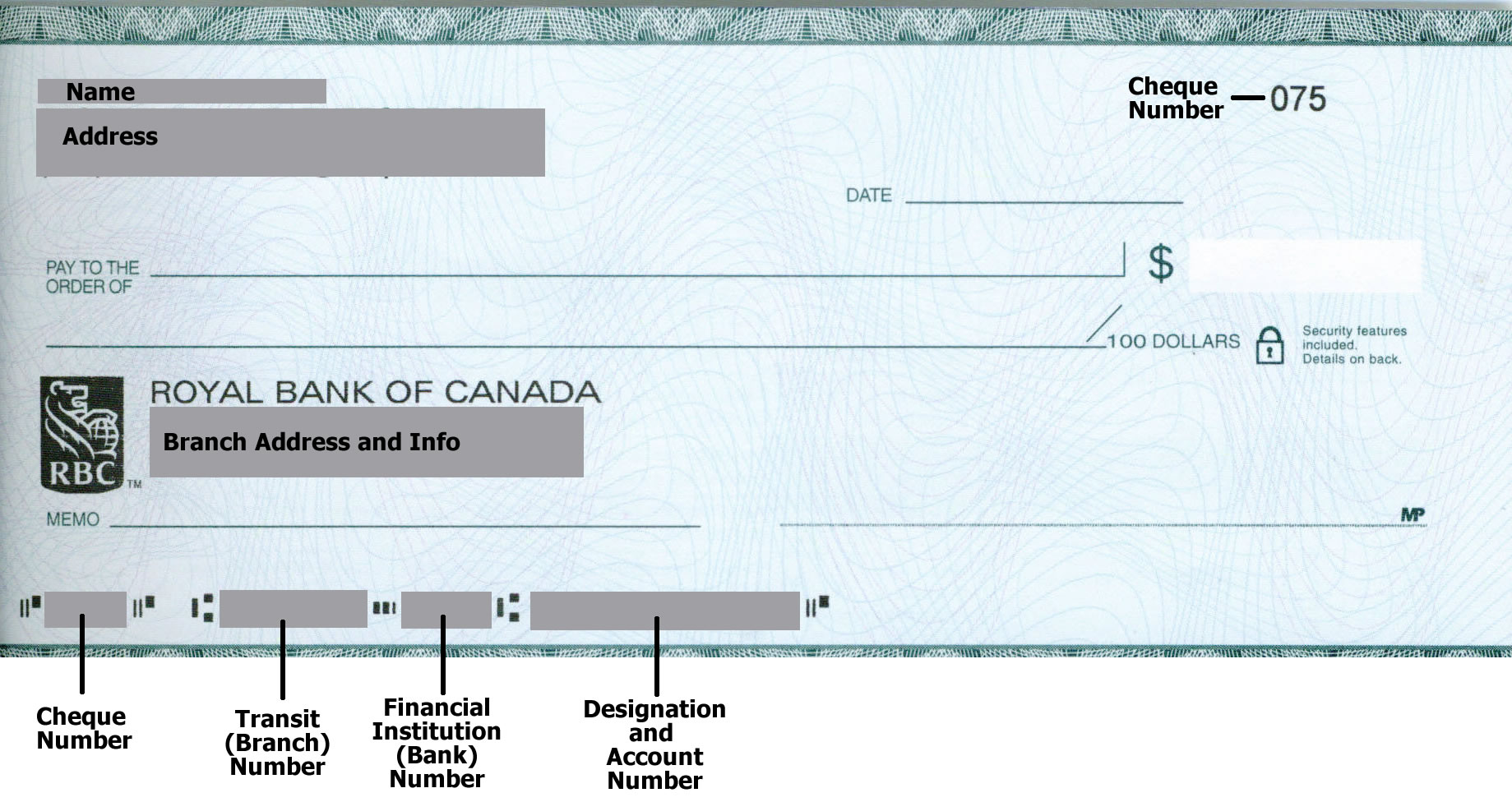

Decoding the Structure of RBC Routing Numbers

RBC routing numbers consist of eight digits, forming a code that reveals valuable information:

-

The first three digits: Typically correspond to the specific RBC branch or department.

-

The remaining five digits: Reflect the broader region or province where the branch is located.

RBC Routing Numbers for Common Transactions

When dealing with common banking transactions, understanding which routing numbers to use is crucial:

-

Interac e-Transfers: When sending money through RBC e-Transfer, you’ll need the recipient’s bank’s routing number to ensure smooth transfer.

-

Bill Payments: The routing number for the biller’s financial institution enables seamless payment processing.

-

Direct Deposits: For receiving your paycheck, government benefits, or other payments directly into your RBC account, the payer will require the correct routing number.

Navigating the World of Inter-Bank Transfers

Routing numbers play a critical role in inter-bank transfers, where money moves between different financial institutions. They help identify both the originating and receiving banks, ensuring that the transaction proceeds efficiently and securely.

Preventing Fraudulent Activities

Routing numbers serve as a vital layer of protection against fraudulent activities. By ensuring that transactions only utilize legitimate routing numbers, financial institutions can mitigate the risk of unauthorized transfers and financial scams.

What to Do If You Encounter a Routing Number Error

In the event that a transaction results in an error due to an incorrect routing number, don’t panic.

-

Contact Your Bank: Get in touch with RBC customer service immediately to explain the error and initiate resolution.

-

Verify Routing Numbers Carefully: Double-check all routing numbers before submitting any transactions to avoid future mistakes.

Beyond Routing Numbers: Essential Tips for Managing Your Finances

While understanding routing numbers is crucial, it’s merely one piece of the financial puzzle. Here are some tips to enhance your overall financial management:

-

Review Your Bank Statements Regularly: Regularly review your bank statements, not just for transactions but also to ensure the accuracy of your routing number, especially after changes to your account.

-

Explore Budgeting Tools: Many available budgeting tools can help you track your spending, manage your accounts, and make informed financial decisions.

-

Develop a Financial Plan: By creating a comprehensive financial plan, you can set financial goals and develop strategies to reach them.

Royal Bank Of Canada Routing Numbers

Conclusion: Embracing Financial Literacy

In today’s complex financial landscape, understanding crucial concepts like routing numbers empowers you to navigate the banking system with confidence. As you’ve learned, routing numbers serve as the vital guideposts that ensure your financial transactions reach their intended destinations securely and efficiently. By embracing financial literacy, you can take control of your finances and make informed decisions that guide you toward a brighter financial future.