Imagine this: you’ve just landed your dream job, the excitement of a fresh start bubbling within you. But there’s one crucial step before you can fully take advantage of your newfound opportunity – securing a loan for your first apartment, a new car, or perhaps even a much-needed vacation. You walk into the bank, ready to embark on this financial journey, only to be met with a request that throws a wrench into your plans – a confirmation letter of employment. Ever wondered what this mysterious document is and why it holds such weight in the banking world?

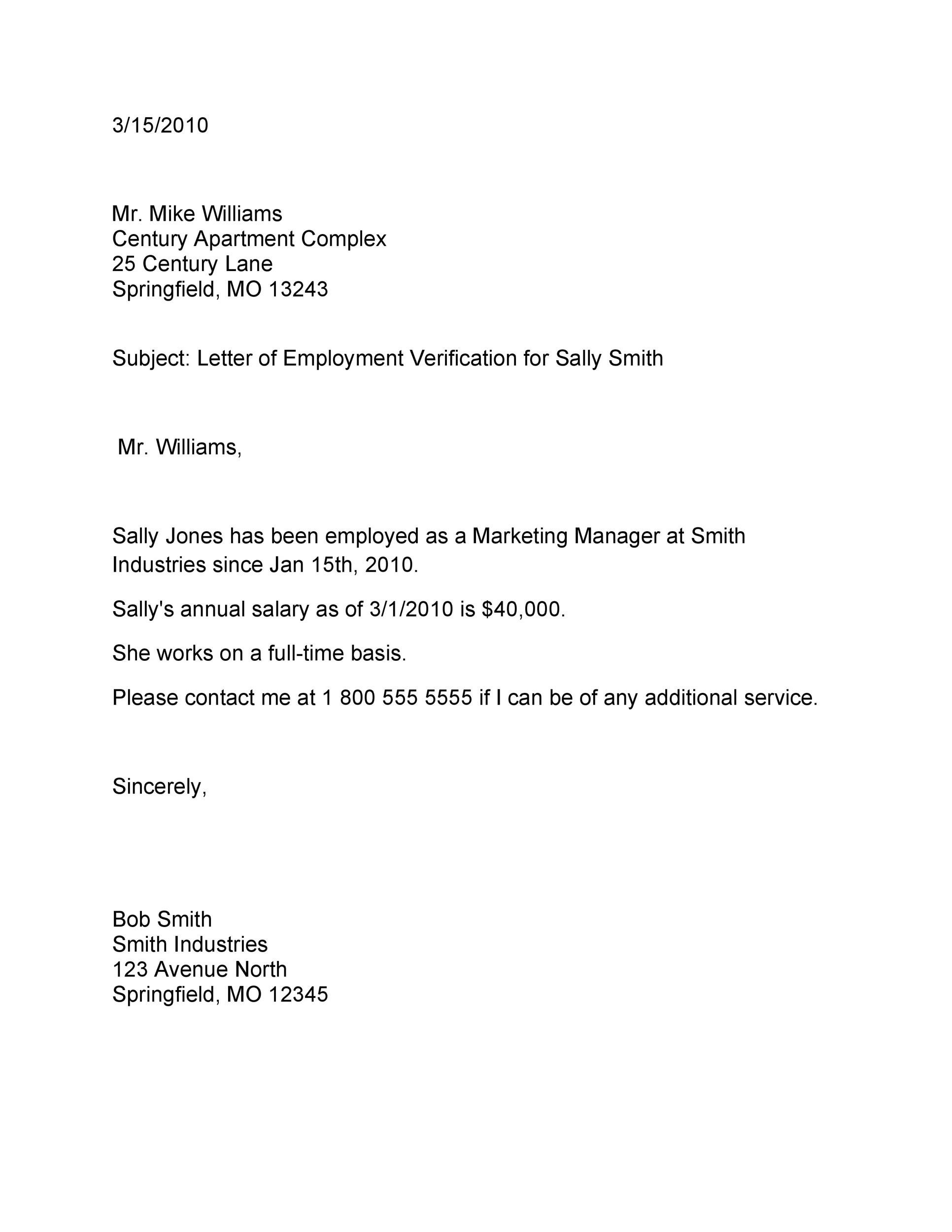

Image: simpleartifact.com

This seemingly simple piece of paper holds incredible power, serving as a bridge between your employment status and your financial aspirations. It’s more than just a formality; it’s a crucial verification of your employment details, a testament to your ability to repay your loan. The confirmation letter of employment is the cornerstone of trust in the financial world, a silent guardian of your creditworthiness and a key to unlocking financial freedom.

Unveiling the Mysteries of the Confirmation Letter of Employment

The confirmation letter of employment is essentially a written confirmation from your employer, meticulously outlining your employment details. It’s like a digital badge of honor, showcasing your current job status and your income potential. This letter is typically requested by lenders when you apply for any type of loan, be it a personal loan, a mortgage, or even a credit card. It’s a vital document that helps banks assess your financial standing, allowing them to make informed decisions about whether to grant you a loan and how much they’re willing to lend.

A Deep Dive into the Importance of Confirmation Letters

Think of the confirmation letter as a comprehensive portrait of your financial picture. It provides the lender with vital information, including:

- Your Name: A basic but essential detail, ensuring the letter is for the correct individual.

- Your Job Title: This helps the lender understand your role and potential earning power.

- Your Start Date: This demonstrates how long you’ve been with the company, providing insight into your job stability.

- Your Salary: The ultimate measure of your earning capacity, informing the lender of your potential repayment ability.

- Your Employment Status: Whether you’re a full-time, part-time, or contract employee, this detail sheds light on your commitment to the job and your income predictability.

- Contact Information for Your Employer: This enables the lender to verify the information provided in the letter.

Navigating the Labyrinth of Loan Approvals

The confirmation letter of employment can be the stepping stone to reaching your financial goals, acting as a passport to unlocking the world of loan approvals. But why is it so important?

- Building Trust: Confirmation letters are essential for building trust between individuals and financial institutions. They serve as a verifiable record of your employment history and potential income, giving the lender confidence in your ability to repay the loan.

- Minimizing Risk: Lenders are risk-averse. They need to be sure that they’ll get their money back. The confirmation letter helps lenders assess the likelihood of you successfully repaying your loan, reducing their overall risk.

- Facilitating the Loan Process: Confirmation letters are a standard requirement for most loans. Without one, your loan application may be stalled, delaying your financial goals.

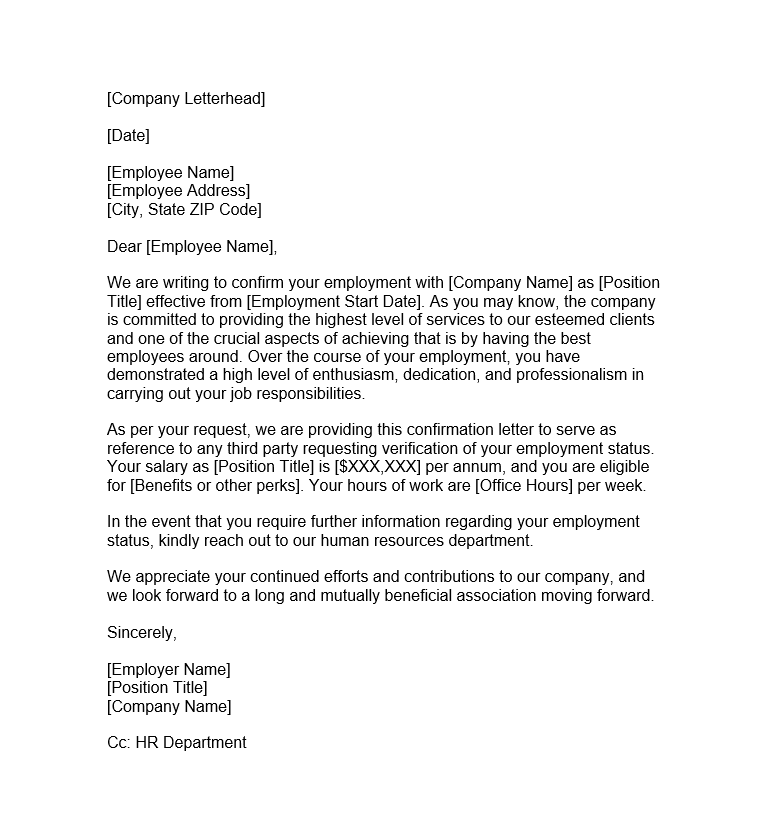

Image: blanker.org

Unveiling the Secrets of a Successful Confirmation Letter

While the confirmation letter itself is crucial, it’s important to understand the factors that contribute to its effectiveness, making sure you’re properly equipped to overcome any potential hurdles:

- Accuracy is King: Ensure that the information in your confirmation letter is accurate and up-to-date. Any discrepancies can raise red flags and potentially delay your loan approval.

- Clarity Matters: The language in your confirmation letter should be clear and concise. Use plain language, avoid jargon, and ensure the information is easy to understand.

- Timeliness Counts: Submit your confirmation letter promptly when requested. Delays can disrupt the loan process and cause frustration for both you and the lender.

Tips and Tricks to Master the Confirmation Letter Maze

Even with your confirmation letter in hand, there are a few strategies to enhance your financial journey and navigate the loan approval process smoothly:

- Understand Your Credit Score: Your credit score is a vital factor in loan approval. By understanding your score, you can identify potential areas for improvement and take steps to boost your creditworthiness.

- Prepare a Budget: A detailed budget can show lenders that you can manage your finances effectively, increasing the chances of loan approval.

- Shop Around: Compare interest rates and loan terms from multiple lenders. It’s advisable to explore different financial institutions and see which offers the most favorable conditions.

Confirmation Letter Of Employment To The Bank

The Final Verdict: Your Key to Financial Freedom

The confirmation letter of employment acts as a vital bridge between your employment status and your financial aspirations, empowering you to unlock the doors to your financial future. This seemingly simple document plays a pivotal role in your loan approval journey, serving as a testament to your creditworthiness and a key to achieving your financial goals. By understanding its significance and following the tips to ensure a successful application, you can embark upon a confident path towards financial security and realize your dreams.