Have you ever received a check and noticed the enigmatic letters “MP” printed on it? Perhaps it was a refund, a settlement, or even a paycheck. You might have wondered, “What does MP mean?” and felt a pang of confusion. Well, worry no more! This article delves into the world of check markings and sheds light on the meaning of “MP.” We’ll explore the history, the significance, and the practical implications of this seemingly simple notation.

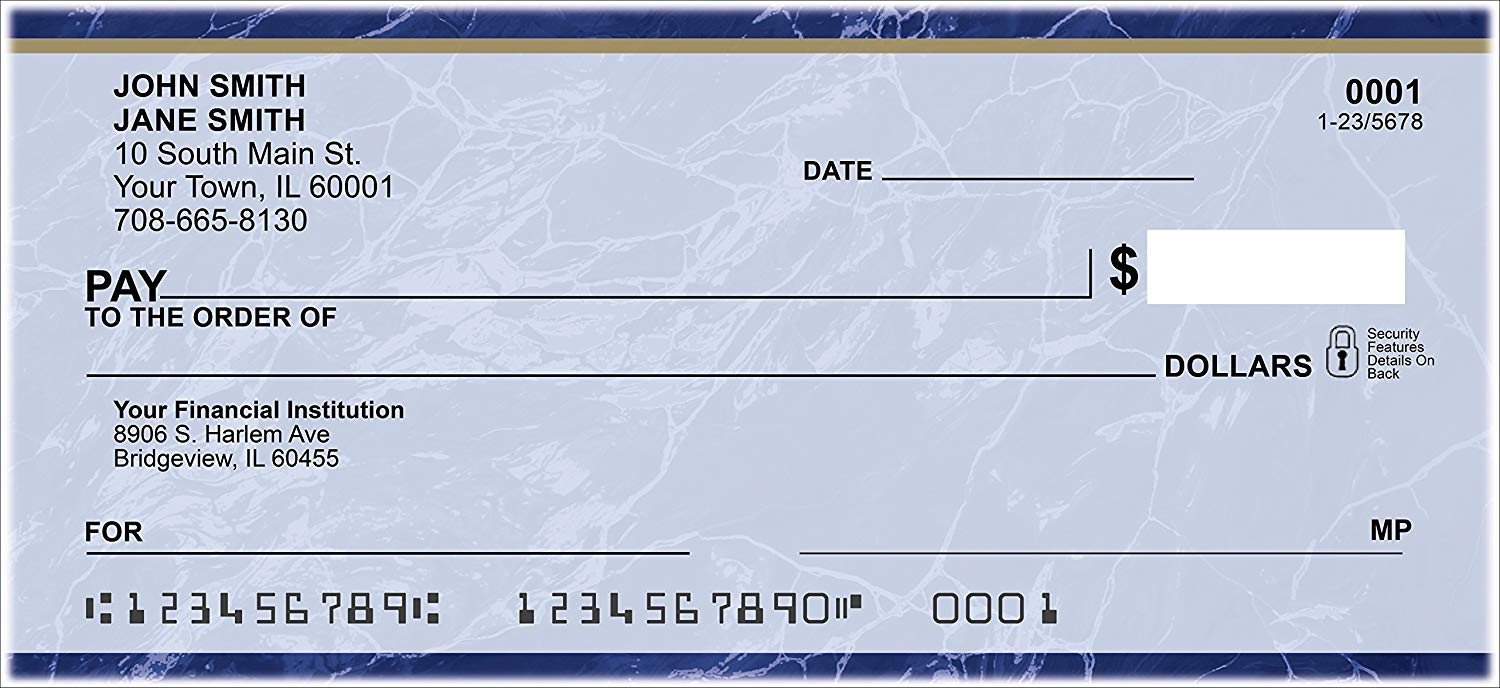

Image: nowiknow.com

The world of checks, despite their declining popularity, still retains a certain mystique. They represent a tangible manifestation of financial transactions, carrying a weight that digital platforms sometimes lack. Those little abbreviations and markings on checks often spark curiosity, prompting us to wonder about their underlying meanings. So, let’s unmask the mystery behind “MP” and discover its role in the financial ecosystem.

Decoding the Meaning of “MP” on a Check

“MP” on a check stands for “Memo Post.” This abbreviation signifies a specific purpose or reason for the check’s issuance. It’s a way for the issuer to provide additional information beyond the standard details like the payee’s name and the amount. Essentially, it’s a brief note attached to the check, similar to a memo you might write in an email or a letter.

The importance of the “MP” notation lies in its ability to clarify the intended purpose of the check. It helps to prevent misunderstandings and ensures transparency in financial transactions. Whether it’s for rent, a specific bill, a deposit, or any other purpose, the “MP” designation helps to keep things organized and clear.

The History of Check Markings: From Simplicity to Complexity

To truly understand the significance of “MP” and other check markings, we need to delve into their historical roots. Checks emerged in the 17th century as a safe and convenient alternative to carrying large sums of cash. They were essentially written orders instructing a bank to pay a specific amount to the named individual.

In the early days, check markings were relatively simple. They primarily served as a tool for identification and tracking transactions. Over time, as banking practices evolved, so did the use of check markings. They became more sophisticated, incorporating abbreviations, symbols, and special codes to convey a wider range of information.

The Evolution of Check Markings and “MP”

With the rise of digital banking, the use of checks has declined significantly. However, checks still play a vital role in certain industries and personal transactions. The need for clear and standardized communication remains as crucial as ever.

In this context, check markings like “MP” play a significant role. They are a fundamental part of a system that ensures accurate and efficient processing of checks. By providing a framework for communication, these markings help to streamline financial transactions, minimize errors, and contribute to a smoother flow of funds.

Image: www.bankdealguy.com

Understanding “MP” in Different Contexts

The “MP” designation is versatile and serves different purposes depending on the context. Let’s explore some common scenarios where “MP” is used:

1. Personal Checks:

When writing personal checks, “MP” can be used to indicate the purpose of payment. For example, you might write “MP: Rent” or “MP: Utility Bill” to clarify the reason for the check’s issuance. This can be especially helpful if you have multiple bills to pay and want to ensure each check goes to the correct recipient.

2. Business Checks:

In business settings, “MP” is frequently used for similar purposes as in personal checks. Companies often use it to indicate specific invoices, purchase orders, or project payments. This helps with internal accounting and recordkeeping, ensuring that every transaction is accurately tracked and categorized.

3. Government Checks:

Government agencies frequently issue checks for various programs and services. The “MP” designation often indicates the specific program or benefit being provided. This can range from social security payments to tax refunds to program grants.

4. Settlement Checks:

In legal proceedings or financial settlements, “MP” can be used to specify the nature of the settlement. For example, you might see “MP: Personal Injury Claim” or “MP: Property Damage” on a settlement check.

Real-World Examples of “MP” Usage

To illustrate the practical implications of “MP” on checks, let’s consider some tangible examples:

- John receives a check from his employer with “MP: Salary” written in the memo line. This clearly indicates that the check represents his regular monthly earnings.

- Mary receives a settlement check for a car accident with “MP: Personal Injury Claim” written on it. This informs her that the check is specifically for compensation related to the injury caused by the accident.

- Richard receives a refund check from the IRS with “MP: Tax Overpayment” written in the memo line. This clearly identifies the check as a refund for overpaid taxes.

Expert Advice on Utilizing Check Markings

When it comes to check markings like “MP”, there are a few key insights from experts to remember:

- Clarity is Key: Prioritize clear and concise language when using “MP” or any other check marking. Avoid ambiguity and ensure the intended purpose is immediately comprehensible.

- Consistency is Crucial: Strive for consistency in your use of check markings. Develop a system that you can consistently apply to streamline your financial transactions and improve recordkeeping.

- Professionalism Matters: Ensure that your check markings are legible and professionally presented. This reflects positively on your organization and contributes to a professional image.

What Does Mp On A Check Mean

Embracing the Significance of Check Markings

In the era of digital banking, check markings may seem like a relic of the past. However, they remain an integral part of the check-writing process, contributing significantly to clarity, organization, and efficiency. Understanding their importance empowers you to navigate financial transactions with confidence, ensuring accurate and transparent communication.

So, the next time you receive a check with “MP” or any other markings, don’t just dismiss it as a simple notation. Take a moment to appreciate its role in the financial ecosystem and how it contributes to a smoother and more transparent flow of funds.