Imagine this: You’ve been paying your insurance premiums diligently for years, but now you find yourself in a situation where you no longer need the coverage. Perhaps you’ve sold your car, moved to a new location, or simply found a more suitable plan. Whatever the reason, canceling your insurance policy is a necessary step, and doing it correctly is crucial. This guide will provide you with a comprehensive understanding of the process, including a standard letter format to help you effectively communicate your cancellation request to your insurer.

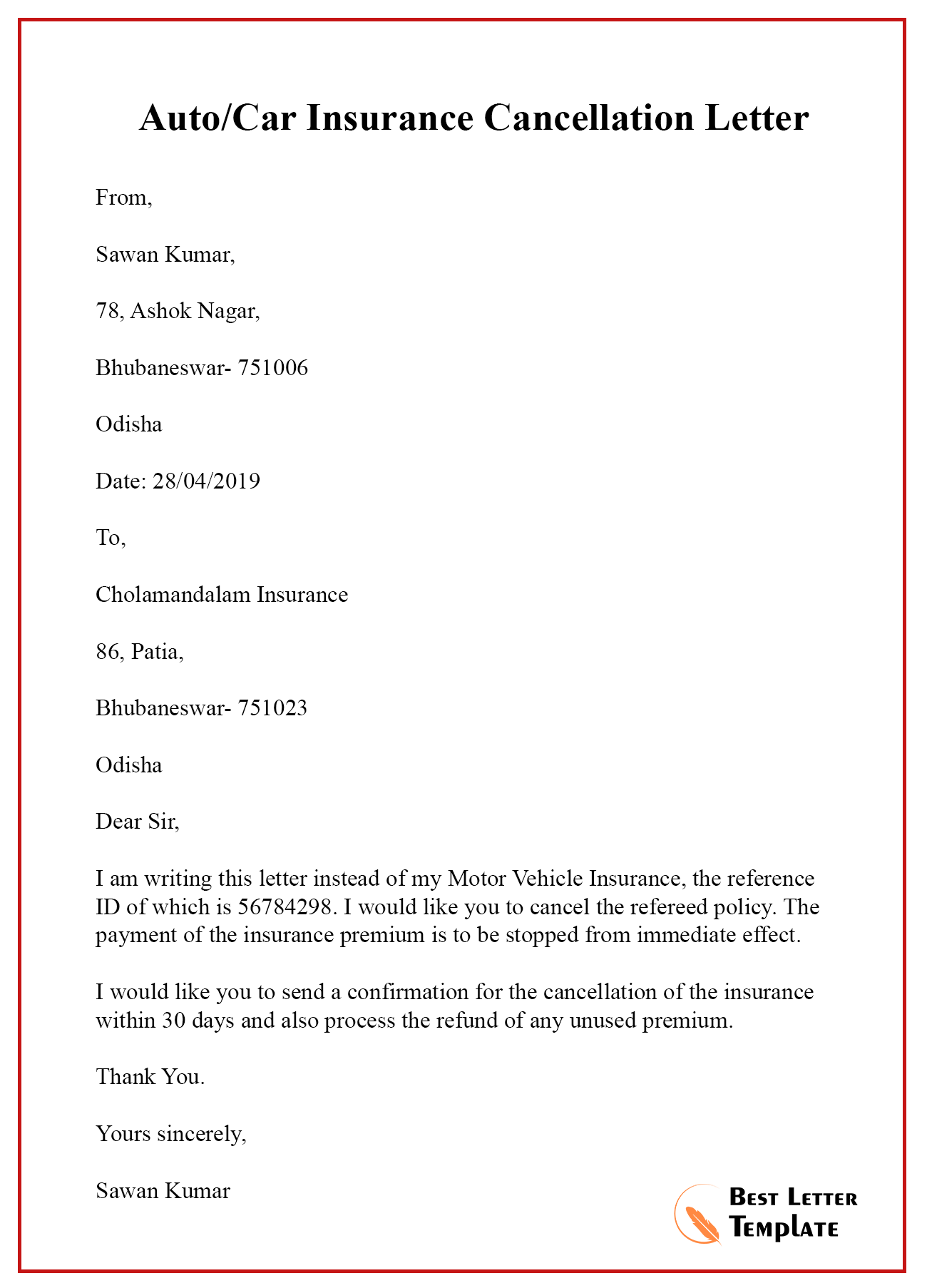

Image: bestlettertemplate.com

Navigating the complexities of insurance can be overwhelming, but understanding the cancellation process is a critical step towards ensuring a smooth transition. Whether you’re dealing with a car insurance policy, home insurance, or any other type, a clear and concise communication with your insurer is key. This guide offers a structured format for your cancellation letter, along with important factors to consider during the process.

Understanding Insurance Policy Cancellation

Definition and Process

Canceling an insurance policy is essentially terminating the agreement between you and the insurance company. This means you’re no longer covered under the policy, and the insurer stops providing you with the agreed-upon protection against risks. The process typically involves informing the insurer of your decision in writing, following their specific procedures, and potentially paying any outstanding premiums or fees.

Reasons for Cancellation

Your reasons for canceling an insurance policy can vary. Some common reasons include:

- Selling or trading your insured asset: This often occurs when selling a car, moving to a new house, or getting rid of an insured item.

- Changing insurance providers: You might find a more affordable or comprehensive policy with another insurer.

- No longer needing coverage: If you’re no longer driving, owning a home, or have other circumstances that make the insurance redundant, you may decide to cancel the policy.

- Dissatisfaction with the insurer: If you have experienced poor customer service, high premiums, or unresolved issues, you may choose to cancel.

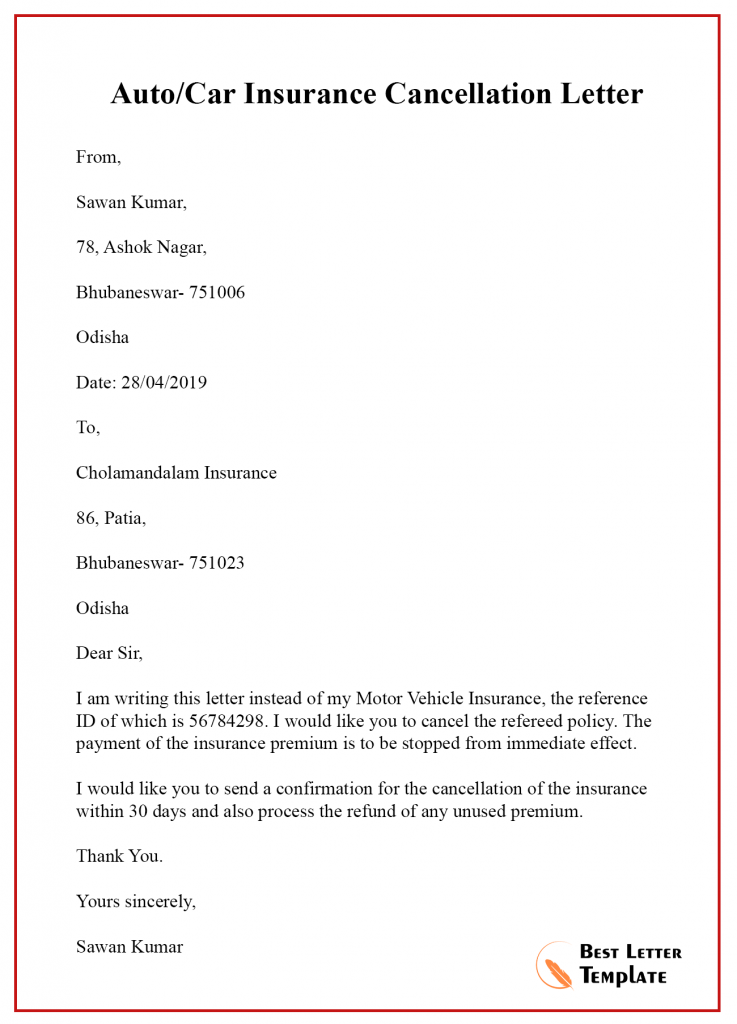

Image: bestlettertemplate.com

Impact of Cancellation and Potential Consequences

Canceling your insurance policy can have both positive and negative impacts. On the positive side, you’ll stop paying premiums and may receive a refund for unused coverage. However, canceling your policy can leave you vulnerable to financial losses if an unexpected event occurs while you’re uninsured. It’s crucial to consider the consequences before making the decision and ensure you have alternative arrangements in place if necessary.

Key Factors to Consider Before Cancellation

Before canceling your insurance policy, it’s essential to consider some critical aspects:

- Any outstanding premiums: Make sure you’ve paid all your premiums up to date to avoid incurring penalties or late fees.

- Cancellation fees: Most insurance companies charge cancellation fees, which can vary depending on the policy and provider. Inquire about any applicable fees before submitting your cancellation request.

- Coverage dates: Understand the effective date of your policy cancellation to ensure you’re not left uninsured even for a short period.

- Alternative coverage: If you’re switching insurers or no longer need the same type of coverage, explore your options for new policies to avoid gaps in your insurance protection.

Writing a Cancellation Letter: Format and Content

Standard Format for Cancellation Letter

Here’s a standard format to follow for your insurance policy cancellation letter:

Your Name

Your Address

Your Phone Number

Your Email Address

Date

Insurance Company Name

Insurance Company Address

Subject: Cancellation Request for Policy [Policy Number]

Dear [Insurance Company Contact Person],

This letter serves as formal notification that I wish to cancel my insurance policy, [Policy Number], effective [Desired Cancellation Date].

Please confirm receipt of this request and provide me with any necessary instructions or documentation for the cancellation process. I request a refund of any unused premium amounts, if applicable.

Please note the reason for cancellation in this paragraph: [State your specific reason for cancellation, e.g., selling the car, changing providers, etc.]

Thank you for your time and attention to this matter.

Sincerely,

[Your Signature]

[Your Typed Name]

Crucial Elements of the Letter

When crafting your cancellation letter, ensure you include the following:

- Policy Number: This is crucial for identifying your specific policy.

- Cancellation Date: State the exact date you wish to have the policy canceled.

- Reason for Cancellation: Clearly explain why you’re canceling the policy.

- Contact Information: Provide your current contact details for the insurer to respond.

- Refund Request: If you anticipate receiving a refund for unused premiums, make sure to mention it.

- Confirmation: Request confirmation of receipt and the next steps in the cancellation process.

Tips for Writing an Effective Cancellation Letter

To ensure your cancellation request is processed smoothly, follow these tips:

- Be clear and concise: Use simple language and avoid technical jargon.

- Provide accurate information: Double-check all details, especially your policy number and desired cancellation date.

- Maintain a professional tone: Even if you’re dissatisfied with the insurer, remain courteous and objective in your letter.

- Submit the letter by certified mail: This provides proof of delivery, which can be useful in case of any disputes.

Example Cancellation Letter for Car Insurance

To illustrate the use of the standard format, here’s an example of a car insurance cancellation letter:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

Subject: Cancellation Request for Policy [Policy Number]

Dear [Insurance Company Contact Person],

This letter serves as formal notification that I wish to cancel my car insurance policy, [Policy Number], effective [Desired Cancellation Date].

Please confirm receipt of this request and provide me with any necessary instructions or documentation for the cancellation process. I request a refund of any unused premium amounts, if applicable.

I am canceling this policy because I have sold my car, [Car Make and Model], and no longer require coverage.

Thank you for your time and attention to this matter.

Sincerely,

[Your Signature]

[Your Typed Name]

Cancellation Process and Confirmation

Steps After Submitting the Letter

After sending your cancellation letter, you should receive a confirmation from your insurance company. They may request additional information or require you to sign specific documents. Make sure to keep a copy of all correspondence related to the cancellation, including the letter you sent and any replies you receive.

Confirmation and Refund

Once the cancellation is processed, the insurer will send you an official confirmation letter. This letter will confirm the effective date of cancellation and details any applicable refunds. It’s important to retain this confirmation as proof of the cancellation process.

Important to Remember

Remember, canceling your insurance policy doesn’t necessarily mean you’re completely free from obligations. It’s crucial to understand the cancellation conditions and any potential consequences. If you’re unsure about anything, contact your insurer directly for clarification.

FAQ: Cancellation of Insurance Policy

Q: What happens if I don’t cancel my insurance policy and simply stop paying premiums?

A: This is a common mistake. If you stop paying premiums, your policy may lapse, leaving you uninsured. Lapsing a policy can have severe consequences, especially if an incident requiring coverage occurs.

Q: Can I cancel my insurance policy before its term ends?

A: Yes, you can usually cancel your policy before the end of its term. However, you may be subject to cancellation fees or penalties. Check your policy documents or contact your insurer for details.

Q: What if there’s a claim pending when I cancel my policy?

A: A pending claim will generally not be affected by policy cancellation. Your insurer should still process the claim based on the terms of your policy before cancellation.

Letter Format For Cancellation Of Insurance Policy

Conclusion

In conclusion, understanding the cancellation process for insurance policies is essential for maximizing your financial well-being. This guide provides a comprehensive explanation of the process, a standard letter format, and crucial factors to consider before making a decision. Remember to always check your policy documents, communicate with your insurer clearly, and keep all related documentation for your records.

Are you interested in learning more about other aspects of insurance cancellation? Let us know in the comments below.