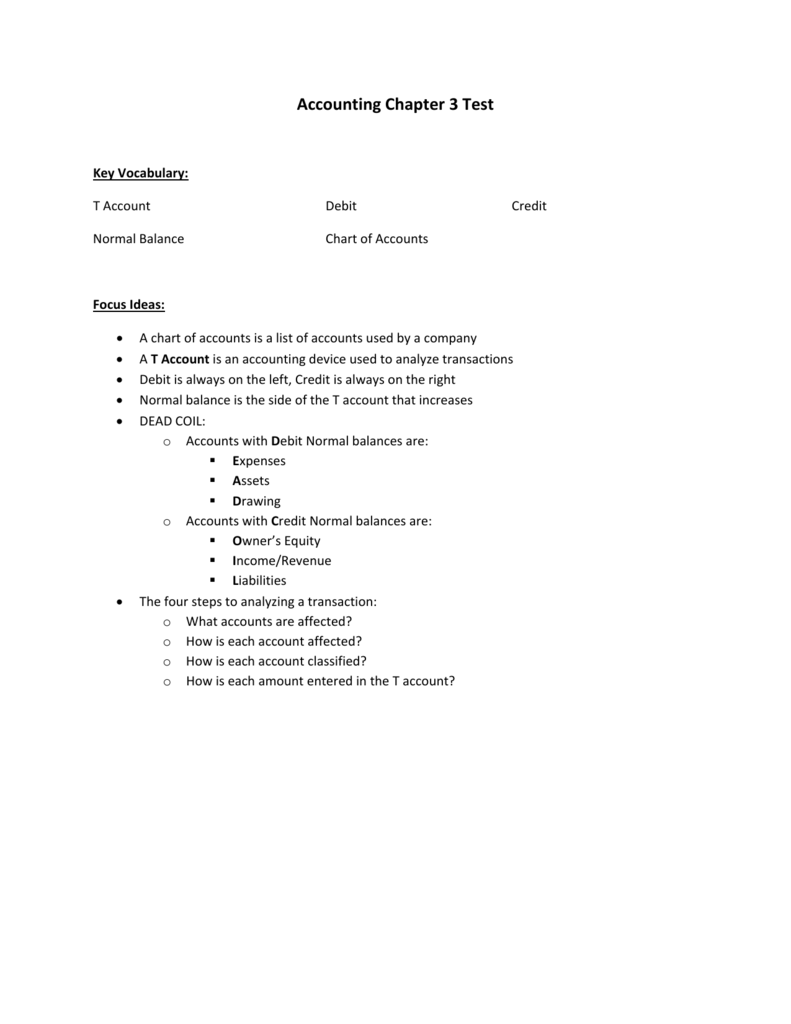

Remember that sinking feeling you get when a pop quiz pops up in class? It’s a feeling that many students can relate to, especially when it comes to accounting. Chapter 4, with its focus on financial statements and analysis, can be particularly daunting. But fear not! This guide goes beyond the usual dry textbook explanations and dives deep into the key concepts you need to master for those Chapter 4 tests.

Image: kaibakarlyle.blogspot.com

Whether you’re a seasoned accounting whiz or a newbie grappling with the basics, this comprehensive guide aims to help you conquer your Chapter 4 test with confidence. We’ll break down the fundamental topics, explore vital analysis techniques, and share study tips that will make your exam preparation a breeze.

Deconstructing the Accounting Framework: Chapter 4 Essentials

Chapter 4 in most accounting textbooks delves into the intricate world of financial statements. These statements are the backbone of financial reporting, offering a snapshot of a company’s financial health. The primary statements you’ll need to understand are the balance sheet, income statement, and statement of cash flows.

Think of the balance sheet as the “snapshot” of a company’s assets, liabilities, and equity at a specific point in time. The income statement, on the other hand, portrays the company’s revenues and expenses over a particular period, ultimately leading to the net income. Finally, the statement of cash flows focuses on the movement of cash within a company. It tracks where cash came from and where it was used during a period, giving investors insights into the company’s financial stability and operational efficiency.

Understanding the Building Blocks of Financial Statements

The foundation of Chapter 4 lies in understanding the components of financial statements. Let’s break these down one by one:

1. Assets: What a Company Owns

Assets are the resources controlled by a company that are expected to provide future economic benefits. These can range from tangible assets like property, plant, and equipment (PP&E) to intangible assets like patents and trademarks. The balance sheet categorizes assets into various types, including current assets like cash and accounts receivable and non-current assets like property and equipment.

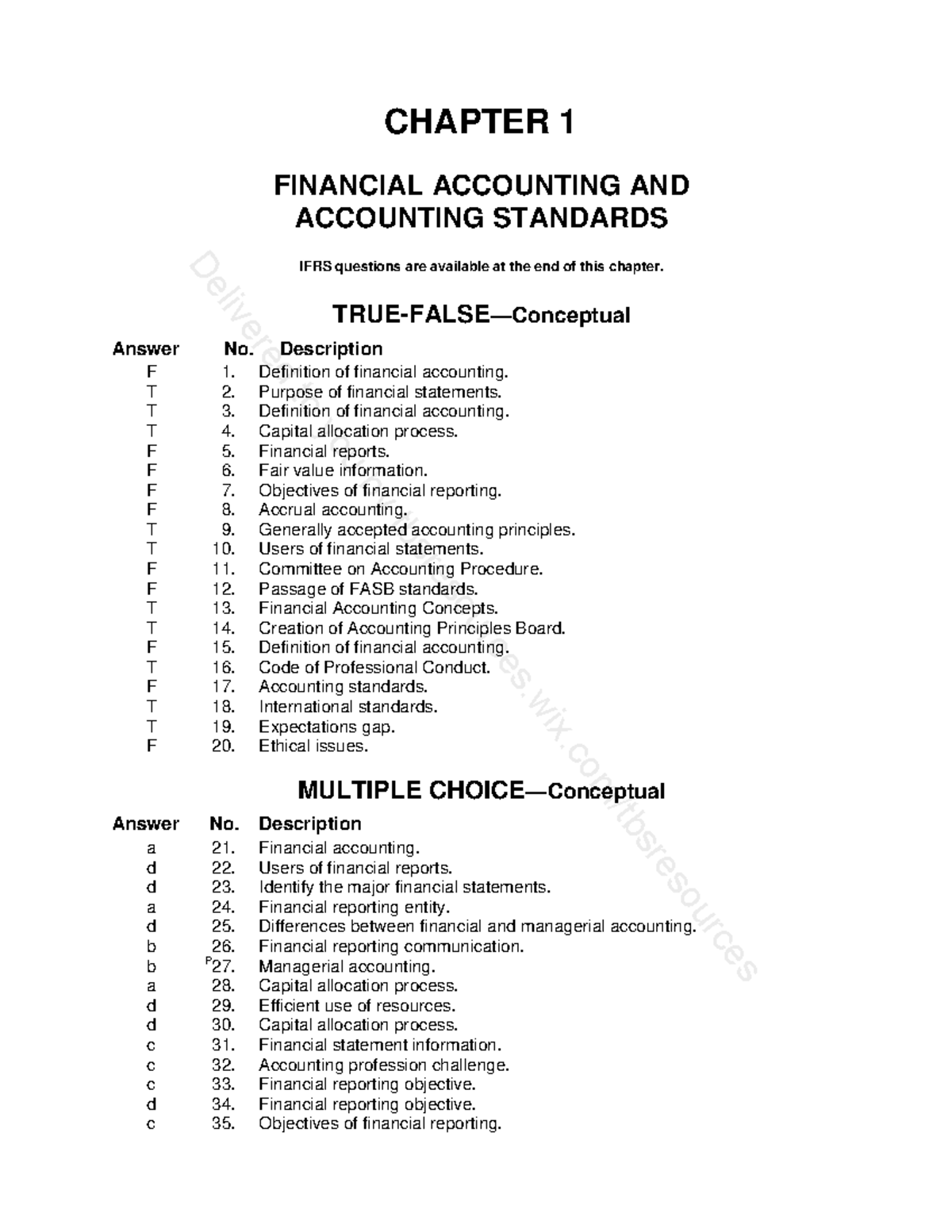

Image: www.studocu.com

2. Liabilities: What a Company Owes

Liabilities represent the obligations that a company has to pay to external parties. They are essentially financial debts that the company owes. Liabilities can be categorized into current liabilities, such as accounts payable and salaries payable, which are expected to be settled within a year, and non-current liabilities like loans and bonds, which are due beyond a year.

3. Equity: The Owners’ Stake

Equity refers to the ownership interest of the owners in a company. It essentially represents the difference between a company’s assets and its liabilities. In simple terms, equity showcases the owner’s stake in the company’s net worth.

Analyzing Financial Statements for Meaningful Insights

The true value of financial statements lies in their analysis. By delving deeper into the numbers, you can glean crucial insights about a company’s performance and financial position. Here are some key analysis techniques covered in Chapter 4:

1. Ratio Analysis: Comparing and Contrasting

Ratio analysis involves comparing different line items on financial statements to form meaningful ratios. Various ratios provide insights into a company’s profitability, liquidity (ability to pay short-term debts), solvency (ability to meet long-term debts), and efficiency. For example, the current ratio helps assess liquidity by comparing current assets to current liabilities.

2. Trend Analysis: Tracking Changes Over Time

Trend analysis examines financial data over multiple periods to identify patterns and trends. By comparing financial statements from different years, you can see how certain financial metrics have changed, indicating positive or negative trends in the company’s performance. For example, observing a consistent increase in net income over several years points to healthy profitability.

3. Common-Size Analysis: Unveiling Proportions

Common-size analysis transforms financial statements into a common-size format, where each line item is expressed as a percentage of a base amount, usually total assets or total revenues. This analysis helps compare financial performance across companies of different sizes or over different periods. For instance, it allows you to see how a particular expense, such as cost of goods sold, is growing relative to total revenue.

Boosting Your Test Prep: Tips and Strategies

Mastering Chapter 4 requires deliberate study and efficient preparation. Here are some tried-and-true tips to make your test prep smooth and successful:

1. Active Reading and Note-Taking

Instead of passively reading your textbook, engage with the material. Highlight key concepts and jot down notes in your own words. Actively summarizing and paraphrasing the content in your notes will significantly improve retention.

2. Practice, Practice, Practice!

The best way to test your understanding is to practice solving problems. Work through the examples in your textbook and complete practice quizzes to build your confidence. The more you practice, the better equipped you’ll be to tackle the actual test.

3. Connect with Your Instructor

Don’t hesitate to reach out to your instructor or TA for clarification. Ask questions about concepts you find unclear, seek advice on how to approach specific problems, and take advantage of available office hours. They are your resources for success.

4. Study Groups: Collaborative Learning

Collaborating with your fellow classmates through study groups can be incredibly beneficial. Discuss concepts, work through problems together, and learn from each other’s perspectives. This collaborative approach can help you consolidate your understanding and motivate you to stay on track.

Frequently Asked Questions About Chapter 4 Test A Accounting Answers

Q: I’m struggling with understanding the different types of ratios. What are some helpful resources?

A: There are several resources available. Your textbook will offer explanations and examples. Search online, explore websites like Investopedia, and look for accounting tutorials on YouTube to learn more about specific ratios.

Q: I’m not sure how to analyze the statement of cash flows. What should I focus on?

A: The statement of cash flows demonstrates how a company generates and uses cash. Focus on the operating activities section to understand how much cash the company generated from its main business operations. Pay attention to the investing and financing activities sections to see how the company uses cash to invest in assets and how it raises or repays funds like debt.

Chapter 4 Test A Accounting Answers

https://youtube.com/watch?v=4mxlPs8mXow

Conclusion: It’s All About the Basics

Understanding Chapter 4’s fundamentals is crucial for grasping the world of accounting. By mastering the concepts, analysis techniques, and preparation strategies outlined here, you’ll be well-equipped to tackle your test with confidence. Remember: The key lies in actively engaging with the material, practicing with problems, and seeking help when needed.

Are you ready to conquer your Chapter 4 test? Let us know your thoughts and share any questions you have!