Have you ever wondered what lies behind the official document that confirms your employment at a bank? It’s more than just a paper trail; it’s a critical piece of documentation that secures your future and establishes your legal standing within the financial institution. This comprehensive guide will unravel the intricacies of a confirmation letter of employment for a bank, delving into its importance, elements, and significance for both employees and employers.

Image: www.lupon.gov.ph

Beyond just a formality, a confirmation letter of employment acts as a beacon of certainty, illuminating your employment status and outlining the essential details of your role. This document is not merely a piece of paper; it’s a legal testament to your employment, shielding you from potential disputes and ensuring your rights are recognized and respected.

Why is a Confirmation Letter of Employment Important?

1. Legal Proof of Employment

In the realm of finance, where accuracy and accountability reign supreme, a confirmation letter of employment stands as irrefutable proof of your affiliation with the bank. This document serves as legal evidence, should the need arise, to substantiate your employment status. Whether it’s for visa applications, loan applications, or even for personal legal matters, a confirmation letter provides concrete verification of your connection to the bank.

2. Safeguarding Your Rights

Imagine a scenario where you find yourself facing a dispute with your employer. A confirmation letter of employment acts as a bulwark, outlining your employment terms, contract details, and the agreed-upon responsibilities, providing a solid foundation for you to assert your rights and navigate any legal complexities.

Image: qlettera.blogspot.com

3. Encapsulation of Key Employment Terms

At its core, a confirmation letter of employment acts as a concise summary of your employment agreement. It spells out vital information such as:

- Start Date of Employment: The official day you began your journey with the bank.

- Designation or Job Title : The specific role you hold within the bank’s hierarchy.

- Department: The division or unit you’re assigned to within the bank’s structure.

- Reporting Line : The name and title of your direct supervisor.

- Salaries and Benefits: The compensation structure, including salary, bonuses, and any other perks.

- Working Hours: The standard work hours and any specific shift patterns expected.

- Probation Period: The initial evaluation period before permanent employment is confirmed.

- Notice Period: The duration of notice required by both the employee and the employer for termination of the employment contract.

What Essential Information Should a Confirmation Letter Include?

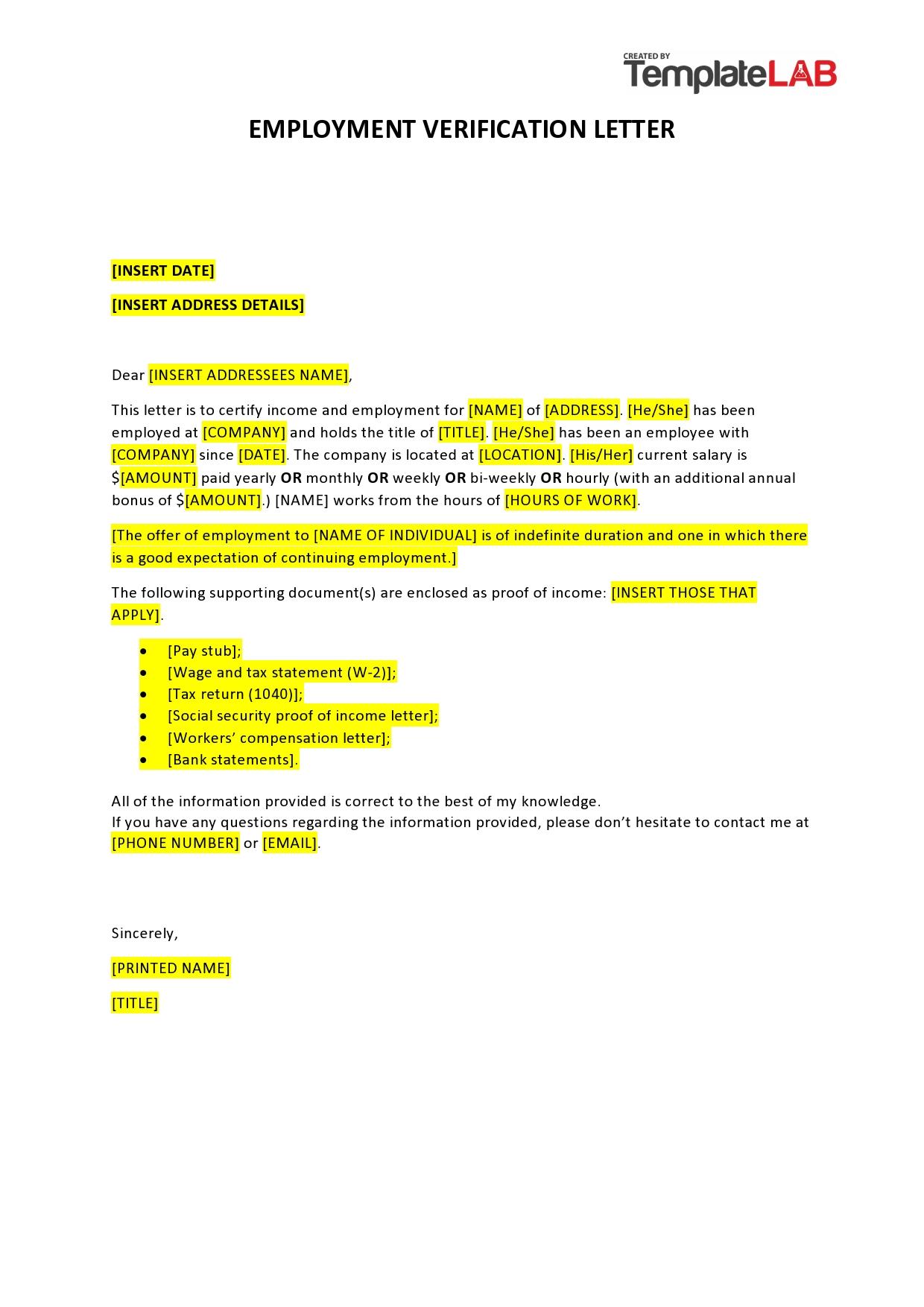

A well-crafted confirmation letter of employment should be more than a mere formality; it should be a comprehensive and informative document that leaves no room for ambiguity. Here’s a breakdown of the key components that typically comprise a confirmation letter:

1. Letterhead and Date

The letter should bear the official letterhead of the bank, clearly displaying its name, address, and contact information. The date of the letter is also crucial, establishing the timeliness and validity of the document.

2. Salutation and Recipient Information

The letter should begin with a formal salutation, like “Dear [Employee Name]”. Include clear and accurate information about the recipient, including their name, position, and contact details.

3. Confirmation Statement

This is the core of the letter, where the bank officially confirms the employee’s employment status. Use a clear and concise statement like,”This letter confirms your employment with [Bank Name] as [Job Title] effective [Start Date].”

4. Key Employment Details

This section delves into the specifics of the employee’s role and contract, covering aspects like:

- Department: The specific area within the bank where the employee is assigned.

- Reporting Line: The name of the individual to whom the employee directly reports.

- Salary and Benefits: The agreed-upon compensation structure, including salary, bonuses, and any other perks.

- Working Hours: The standard work hours and any specific shift patterns expected.

- Probation Period: The initial evaluation period before permanent employment is confirmed.

- Notice Period: The duration of notice required by both the employee and the employer for termination of the employment contract.

5. Additional Clauses

Depending on the nature of the employment, some letters might include additional clauses like:

- Confidentiality Agreement: Clauses outlining the employee’s obligation to maintain the confidentiality of bank information.

- Non-Compete Clause: Restrictions on the employee’s ability to work for a competing firm during or after employment.

- Intellectual Property Rights: Clarification of ownership rights over any intellectual property the employee might create during their employment.

- Dispute Resolution: Outlining the procedures for resolving any conflicts or disputes between the employee and the bank.

6. Signature and Contact Information

The letter must be signed by an authorized representative of the bank, typically a Human Resources manager or the hiring manager. The signature should be followed by the name and title of the signer, along with their contact details.

Confirmation Letter vs. Offer Letter: What’s the Difference?

The distinction between a confirmation letter and an offer letter might seem subtle, but it’s crucial to understand their separate purposes. An offer letter is essentially an invitation to join the bank, outlining the proposed terms of employment and inviting the candidate to accept. In contrast, a confirmation letter is a formal document that confirms the employee’s acceptance of the offer and officially establishes the employment relationship. An offer letter is a proposal, while a confirmation letter is a confirmation of an accepted proposal.

When Do You Need a Confirmation Letter of Employment?

While it’s not always explicitly required, a confirmation letter of employment is a valuable asset to possess. Here are some key scenarios where it becomes particularly important:

1. Visa Applications

Visa applications often require proof of employment, and a confirmation letter can provide the necessary documentation, demonstrating to immigration authorities your secure employment with a reputable financial institution.

2. Loan Applications

For personal loans or mortgage applications, a confirmation letter serves as a key document to verify your income and employment status, enhancing the credibility of your application.

3. Employment Disputes

In the unfortunate event of a labor dispute, a confirmation letter can be vital evidence, outlining the terms of your agreement and providing a solid foundation for any legal proceedings.

4. Verification by Third Parties

Verification of employment is often required by third parties like insurance companies or landlords. A confirmation letter provides official documentation for these situations.

How to Request a Confirmation Letter of Employment

It’s generally considered standard practice for a bank to provide a confirmation letter of employment upon request. Here’s how to approach the process:

1. Formal Request

Compose a professional request to your Human Resources department or your manager, explaining the need for the confirmation letter and the purpose for which you require it. Be specific about the information you need included in the letter.

2. Provide Necessary Information

Be prepared to provide the necessary information, like your full name, employee ID, date of employment, and any other relevant details to expedite the process.

3. Follow Up

If you don’t receive the confirmation letter within a reasonable timeframe, follow up with your HR department or manager to inquire about its status.

Confirmation Letter Of Employment For Bank

Conclusion

In the world of banking, where trust and transparency are paramount, a confirmation letter of employment plays a vital role in securing your future and safeguarding your rights. This document transcends mere formality; it’s a legal cornerstone, providing tangible proof of your affiliation with the bank, outlining the terms of your agreement, and serving as a valuable tool during legal proceedings or third-party verifications. By understanding the value and content of this essential document, you can ensure a more secure and rewarding employment journey in the financial sector.